50% – total living expenses (mortgage or rent, utilities, groceries, eating out, etc.).For example, the 50/30/20 budget works well for many families and individuals who want to do a better job of tracking their spending. If you’re worried about budgeting, keeping it simple may be key.

Eating out less and putting those funds toward an account earmarked for travel can help you achieve a lifestyle goal. For example, if you’ve budgeted a certain percentage of your income to be spent on eating out, but are disappointed that you’re unable to travel as much as you’d like to, you may want to revisit your budget.

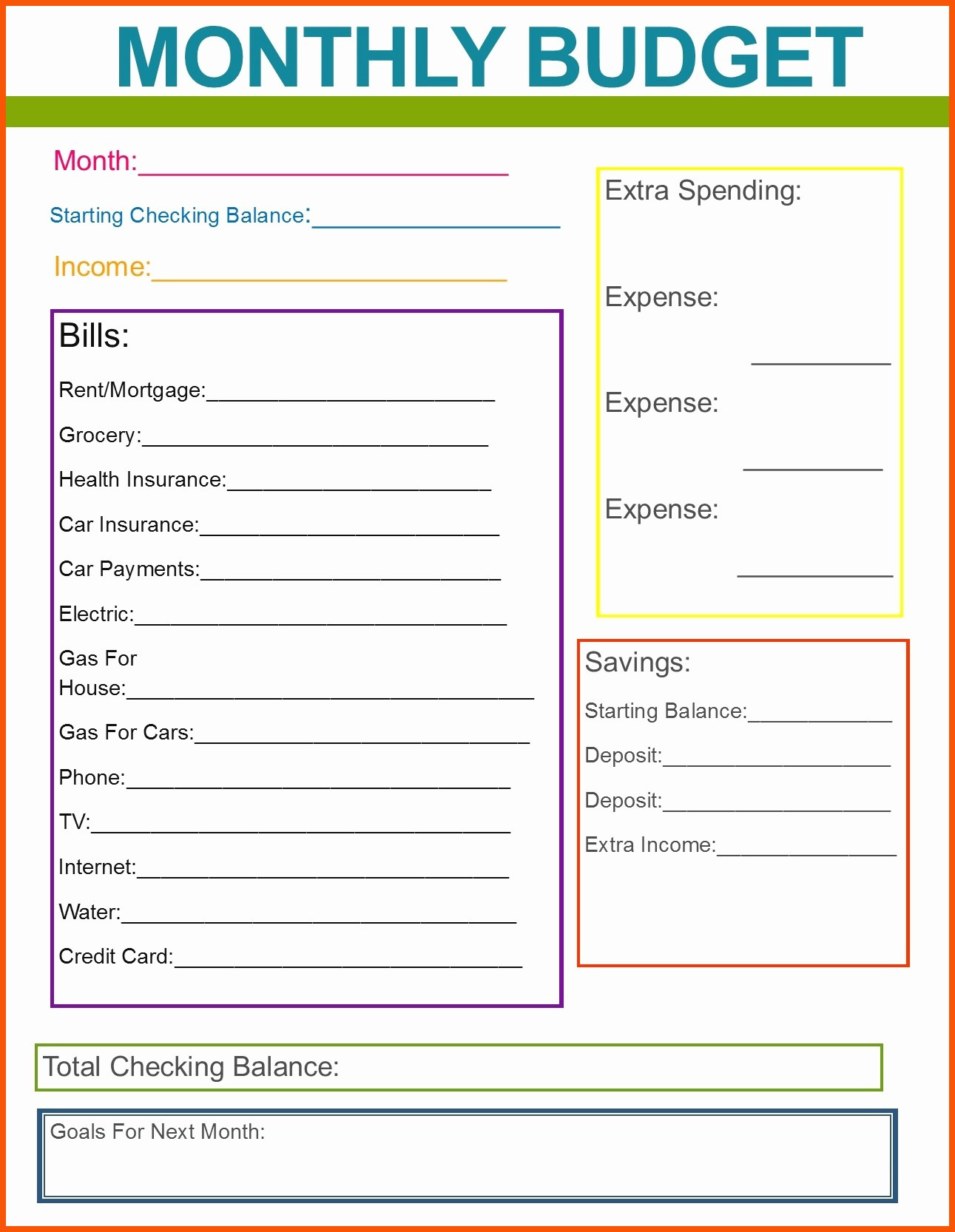

When you review and revise your budget, you’re able to build a spending plan that matches your values and helps you to achieve a fulfilling lifestyle. A budget isn’t meant to be a restriction. Your budget is a living, breathing thing, and will need to be adjusted periodically. Ideally, you’ll leave a margin for other financial goals like building up your savings and paying down your debt. Compare your spending to your take-home income. At a minimum, your monthly spending needs to be lower than your monthly take-home income.I recommend using either an Excel spreadsheet for a slightly elevated method or leverage a budgeting app like Tiller (Budget provider for the Chubb family) or YNAB to auto-track your spending by connecting the app to your bank account. However, this can be tedious and difficult to maintain. You can use a traditional pen-and-paper method to track each expense. Track all of your spending for a few months. Yes – I mean all of it! You can do this in a few different ways.If you see how you’re currently spending your income, you can evaluate what’s working, what’s not, and what you want to adjust in a future budget. As Jerry Maguire says: Show me the money! When you start to build your budget, it can be easier to start with the type of spending you’re currently doing. Then, you’ll need to continuously revisit your budget annually to ensure it’s meeting your needs. Keep in mind that, as you build your budget, you may take 3-4 months to successfully adjust your spending. Tips for building your savings and achieving financial wellness.īudgets may not be easy to put together, but they are well worth it in the long run.What is “good” debt, and what is “bad” debt?.What are some of the best ways to manage debt?.Prefer video over the blog? We’ve got you covered! Watch our YouTube video as we dissect this blog post for you: Key Takeaways: You need to constantly track and evaluate your income and expenses to ensure that you’re on track. The truth is that budgets aren’t a set-it-and-forget-it thing. They think that because they outlined a budget last year (or last month, or last week), and because they loosely keep an eye on their spending, they’re knocking it out of the park.

Many people have an incorrect assumption that they are budgeting and tracking cash flow successfully. Unfortunately, not everyone has a clear handle on their own family’s cash flow. Every other aspect of your personal finances stems from how you balance your income and expenses. Understanding your cash flow and creating a budget is the first step in creating a successful financial plan.

0 kommentar(er)

0 kommentar(er)